What we do

Geared for growth. Built for bigger.

Ambitious, growing businesses have different insurance needs. We have the privilege of supporting some of the UK’s most innovative and ambitious organisations. That’s why we shape our programmes not just for where you are, but where you want to be. We call it next-level thinking. And you’ll like where it can take you.

Experts. In your sector.

FinTech

From cyber threats to regulatory challenges, comprehensive insurance for FinTechs should ensure compliance and ultimately fortify your business against unforeseen events.

Consumer

In an industry constantly subject to changing consumer behaviour, ever-evolving market dynamics, and new regulations, consumer insurance is your key to staying on top.

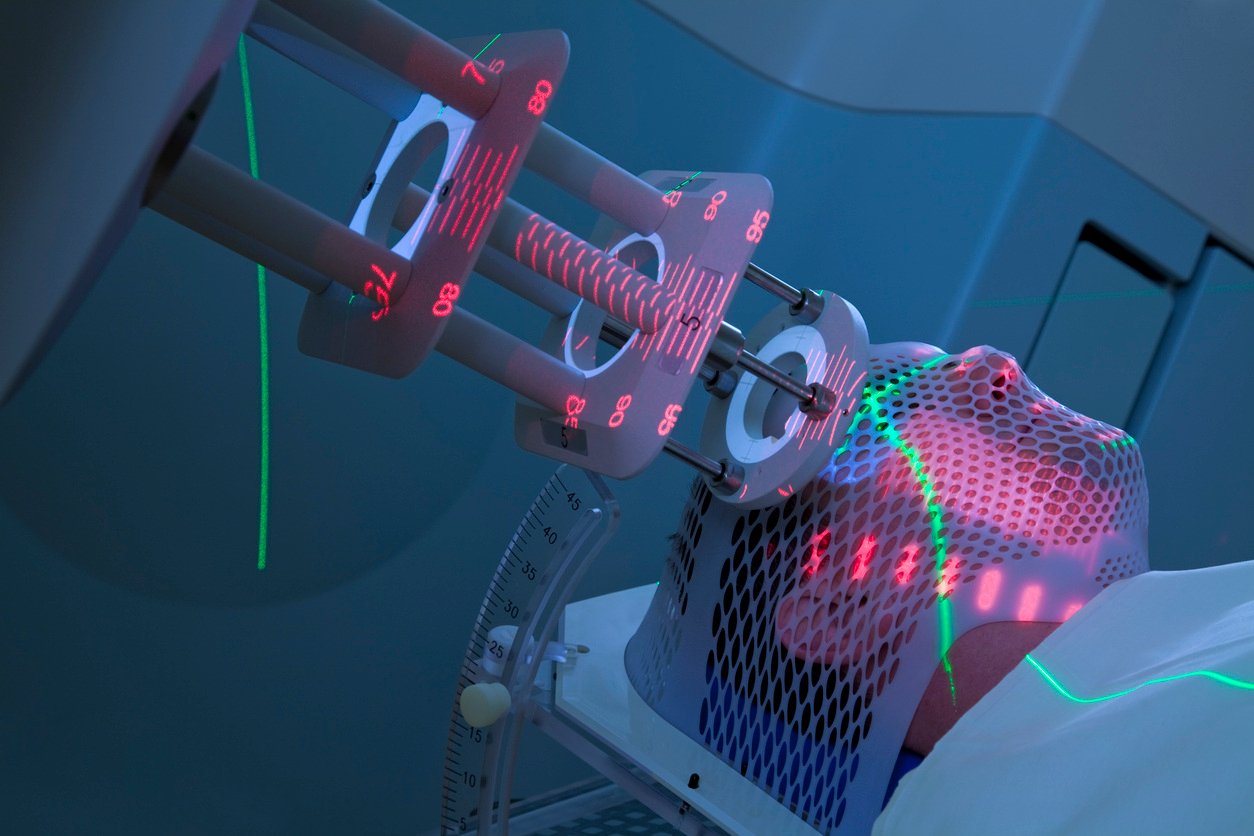

MedTech

Regulatory hurdles, unpredictable research outcomes, and incredible breakthroughs. Throughout all of these, the MedTech industry demands resilience and adaptability.

Technology

Technology enterprises are all about shaking things up and aiming higher. But to dream big, you’ve got to see the big picture. That’s where Technology insurance comes into play.

Venture Capital

The venture capitalist realm is filled with people who think outside the box. But even the brightest ideas can be derailed by the unpredictable nature of the startup landscape.

-1.png?width=1254&height=837&name=Untitled%20design%20(23)-1.png)

Climate

Sustainable businesses are reshaping the future and facing unique risks. As a B Corp, Capsule helps unlock ESG-linked insurance benefits like lower premiums and better terms.

The latest. From Capsule.

Scale-Up 50 2026

.png?width=1000&height=464&name=Web%20page%20image%20bloglist%20(1).png)

The 2026 Scale-Up 50 list has landed. Discover 50 companies shaping the future of UK tech. They are growing at pace, building smarter solutions, and redefining what it means to innovate at scale.

From next-gen FinTechs to MedTechs transforming healthcare, meet the companies leading the way in the UK tech industry!

Case studies

See how we helped scale-ups get better insurance outcomes.

.png?width=1703&height=1080&name=Limbic%20LI%20graphic%20(1).png)

Olio

what3words

When the fast-moving tech company expanded globally, it needed an insurance partner as innovative and agile as its business.

Moneyhub

If you handle insurance for your growing FinTech or worry your coverage isn’t keeping up, your broker must understand more than just price—they should ensure your policy’s limits, wording, structure, and exclusions fit your business.

Learnerbly

Ahead of Learnerbly’s expansion across the pond, we offered advice on territorial and jurisdictional limits – ensuring seamless coverage for potential US clients.

.png?width=1000&height=634&name=peak%20ai%20(2).png)

Peak AI

Capsule teamed up with Peak just weeks before its policy renewal. With the complexities of AI insurance, Peak stepped in to guide the process smoothly and swiftly—delivering expert support under pressure.

.png?width=1000&height=634&name=peak%20ai%20(3).png)

Ocean Bottle

Ocean Bottle has a clear mission: to reduce ocean plastic waste. It’s a fellow B Corp organisation, and it needed an insurance broker who understood its values and evolving insurance needs.

.png?width=1000&height=634&name=peak%20ai%20(4).png)

Cumulus

When Cumulus lost key US coverage—despite 90% of revenue coming from the US—Capsule stepped in, via partner Vouch, to quickly restore protection and keep their neurotech platform on track.

.png?width=1000&height=634&name=peak%20ai%20(6).png)

Welcome to the Jungle

Welcome to the Jungle had just secured funding and needed strong cover for its next stage of growth—leading the team to discover Capsule via the Startup CFO Slack community.

Testimonials

For an evolving business, the importance of insurance solutions aligned with its approach is important. Capsule has, with its extensive FinTech expertise, evaluated and customised Moneyhub's coverage to ensure it meets our exact needs with a focus on our innovative approach. Their exceptional support and strategic partnership have been instrumental in enabling us to grow with assurance and stability.

Warren Turner

Finance Director at Moneyhub

The Capsule team really nailed it with their efficient approach to renewal and their ongoing support throughout the process. Everything felt so much smoother with their transparency and direct communication. They’ve set a new standard for what we look for in external support!

Polly Hughes

CFO at what3words

When we first dreamt up Days back in the early stages of lockdown, we couldn’t have imagined how popular it would become. Shifting from a direct-to-consumer model to stocking shelves triggered a change in our insurance needs, and Capsule managed it from top to bottom. We couldn’t have asked for a better service!

Mike Gamell

Co-Founder at Days Brewing Co.

Our expertise. Shared.

Contact us

Take your next step.

If you’re interested in how we can help or just want to introduce yourself, get in touch. We’re always happy to talk. Alternatively you can book a meeting with one of the team using the Capsule Calendar.

-1.png?width=974&height=180&name=scaleup%2050%202025%20(50)-1.png)