.png?width=2000&height=800&name=Web%20header%20%20(25).png)

Cover to suit you.

Not sure what product you need? Speak to us today

Products

Explore our Products

At Capsule, we make it easy to find the right cover — no matter what your business needs. From protecting your people and operations to securing goods in transit, our tailored solutions are designed to give you peace of mind and keep your business moving forward.

Browse our products and find the cover that fits your business best.

Cover the individuals who lead and power your business - from directions and key employees to staff at all levels.

Business Operations & Legal Cover

Safeguard your business from claims, legal action, or professional mistakes that could impact your reputation or finances.

![]()

![]() Digital & Data Protection

Digital & Data Protection

Stay secure against cyber threats, data breaches, and the cost of business downtime caused by digital risk.

![]()

![]() Travel & Trade Risks

Travel & Trade Risks

Insurance for the things that move, from business trips to global trade and financial exposure.

![]()

Goods & Asset Cover

Protect your premises, stock, cargo, and business continuity against damage, theft, or disruption.

Employers' Liability

Protection from any employee claims linked to workplace health and safety.

Directors' & Officers

This covers founders and some of the leadership team for company mismanagement.

Key Person & Critical Illness

Cover for the financial hit when an essential team member can’t work.

%20(28).png?width=60&height=60&name=webpages%20(300%20x%20300%20px)%20(28).png)

Public Liability

Provides cover for claims made by third parties for injury or property damage.

Product Liability

Cover for third-party claims over injury or damage caused by your products.

Professional Indemnity

Covers claims for losses or damages caused by your advice or services.

Cyber Insurance

Whether it’s an attack or a leak, this cover protects you from any internet-based risks.

%20(58).png?width=70&height=70&name=webpages%20(300%20x%20300%20px)%20(58).png)

Trade Credit

Explore insurance solutions tailored to your industry

FinTech

From cyber threats to regulatory challenges, comprehensive insurance for FinTechs should ensure compliance and ultimately fortify your business against unforeseen events.

Consumer

In an industry constantly subject to changing consumer behaviour, ever-evolving market dynamics, and new regulations, consumer insurance is your key to staying on top.

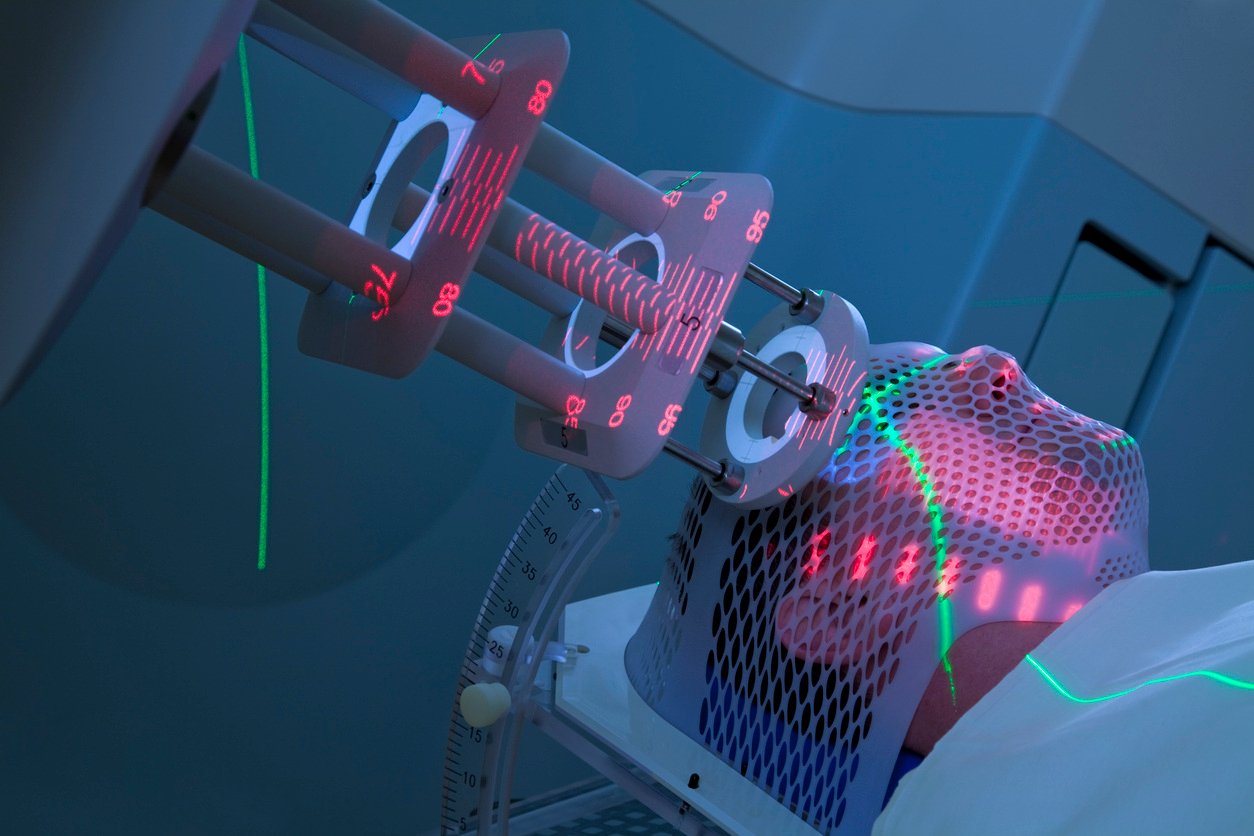

MedTech

Regulatory hurdles, unpredictable research outcomes, and incredible breakthroughs. Throughout all of these, the MedTech industry demands resilience and adaptability.

Technology

Technology enterprises are all about shaking things up and aiming higher. But to dream big, you’ve got to see the big picture. That’s where Technology insurance comes into play.

Venture Capital

The venture capitalist realm is filled with people who think outside the box. But even the brightest ideas can be derailed by the unpredictable nature of the startup landscape.

-1.png?width=1254&height=837&name=Untitled%20design%20(23)-1.png)

Climate

Sustainable businesses are reshaping the future and facing unique risks. As a B Corp, Capsule helps unlock ESG-linked insurance benefits like lower premiums and better terms.

Contact us

Take your next step.

If you’re interested in how we can help or just want to introduce yourself, get in touch. We’re always happy to talk. Alternatively you can book a meeting with one of the team using the Capsule Calendar.