Scaling West: Your insurance roadmap for US expansion

So you’re thinking about your own American dream: and it is a goal for many scale-ups. The US is a gateway to much of the rest of the global market, and it’s exactly how many products go exponential.

You may well have a roadmap for testing different submarkets, networking, hiring, finding your price point, and so on. What you probably don’t have is a roadmap for insurance. And why should you? It’s not something many brokers talk about to their clients - at least not unless they’re asked about it directly.

Interestingly though, the journey of expanding to the US offers a perfect example of why the transactional approach of insurance broking isn’t fit for purpose in the scale-up market. Because if you’ve got your sights set on the US, insurance should definitely be a part of your plan.

So you’re considering expanding to the US? Talk to your broker

The key word when it comes to expanding overseas is “proactive”. The last thing you want is to go through the process of setting up a subsidiary in the US and hiring teams, only to discover later on that your insurance hasn’t kept pace with your growth.

Part of that means being proactive yourself and telling your broker about your expansion plans as far in advance as possible. The earlier they know you’re aiming for US expansion – even if you’re still just in the planning phase – the sooner they can start advising you on what you’ll need and finding the best options.

But on the other side of the partnership should be a proactive broker, too. We’ve seen scale-ups before whose brokers hadn’t recommended anything that wasn’t explicitly spelled out as a need upfront. They might have got all the way to signing a contract with a new US client only to be told, “actually we can’t proceed because you don’t have an ACORD Certificate.”

The best kind of insurance is always the kind that’s recommended well before you need it, not when you need it. At Capsule, we hold regular check-ins and review meetings with our clients so that we always know what their plans are well in advance, and can start preparing for their US expansion as early as they do.

Stage 01: The soft launch

Check your cover

During a soft launch, you’re still trading from the UK but you’re earning a little US revenue as well – just testing the waters of that market.

It may not seem like much but you still need to check your cover. To begin with, you’ll want to check your current cover’s territorial limits – you’ll need it to cover worldwide jurisdictions. Often you’ll find your cover is “worldwide, excluding US”.

So long before you’ve made a single deal abroad, you’ll want to make sure your professional indemnity cover, cyber liability, D&O and public and products liability is all on a worldwide basis including the US.

Consider increasing your policies’ limits

During this “testing the waters” phase, your broker should also be reviewing your policy limits with you.

Your risk increases significantly for D&O insurance, for instance. And as a result, US cover often requires increased excesses or amended limits and/or sub-limits - and we’ve seen companies without a high enough limit to cover them if things go badly out West.

Be aware of US contracts

Once you’re doing business in the US, you’ll see some of your contracts become more demanding. Contracts will likely be asking for you to have additional cover or increased limits, as well as noting additional insureds (which extend the coverage of liability insurance beyond a single named person to others).

You’ll need an insurer that’s happy to cover you in this, but more importantly a broker who understands your US contracts as they’re often riddled with US-specific terminology.

Stage 02: Becoming an entity

Let’s say it’s gone well in the US. Your model is proven there, and you open a US subsidiary where you want to route your revenue. Now what?

Check on your EOR people

At this stage you might potentially employ people through an EOR (employer of record). They’ll handle your insurance – but you need to make sure you’re happy with their terms.

Check they’ve made provisions to protect your workers if things go south, and make sure you’ve got a record of it. Also remember that Workers Compensation is a legal requirement, so it’s important that EOR employees are fully protected.

Get group coverage

Don’t waste your time or money insuring your US subsidiary separately from the rest of your organisation. There can be hidden benefits to having your group covered as a whole – like leaner premiums or enhanced cover – so it’s important to see what policy options are out there.

That goes for your PI insurance, your cyber insurance, your D&O - the lot. Insure your HQ and cascade the cover down to include every subsidiary in your group.

At this stage, you’ll want to review your limits again. The more you expand, the more people you have who are a potential liability - and you can’t afford to be without the cover you need.

Travel insurance

This one’s easy to miss, so it deserves its own section. Naturally, when you’re in the UK, you’ll need travel insurance when you start travelling worldwide.

When you start employing via EOR, you need to make sure your travel insurance policy covers your people over there as well, if they’re travelling. Typically a UK-based travel insurance policy won’t cover US employees. You’ll need to amend your current policy to include them or get a different policy.

Stage 03: Hiring your own people and getting an office

Bring in a US broker

This one’s relatively simple. You can potentially still manage your insurance from the UK even at this stage. But you will need a US broker to issue policies and collect premiums locally, so get in touch with one or see if your UK broker has a partner – like our partnership with US insurance provider Vouch.

Put your people on your workers’ compensation cover

This one’s also simple (so simple it’s easy to miss). Once you’re hiring your own employees directly rather than through an EOR, you’ll need to make sure your workers are covered. One option might be finding a health plan through a professional employer organisation (PEO), which can provide medical, dental and vision insurance as well as life and disability insurance.

Get an ACORD certificate

If you’re selling to the US from the UK, companies are usually happy to see your UK evidence of cover. But once you’re based in the US, it gets more formal, and they may ask for an ACORD certificate. ACORD certificates are issued locally by US brokers for US policies - and they’re essentially documents that prove you have cover, so make sure you have them handy.

Keep general liability in mind

If you’re getting a physical office in the US, or you’re using a co-working space like Regus, you’ll need to think about general liability coverage – or business liability insurance, as we call it in the UK.

If you do need to hold general liability insurance, a company in its early stages can typically get covered under a Business Owners Policy – this includes a bunch of products you can buy digitally and easily in the US.

How we help clients change tracks fast

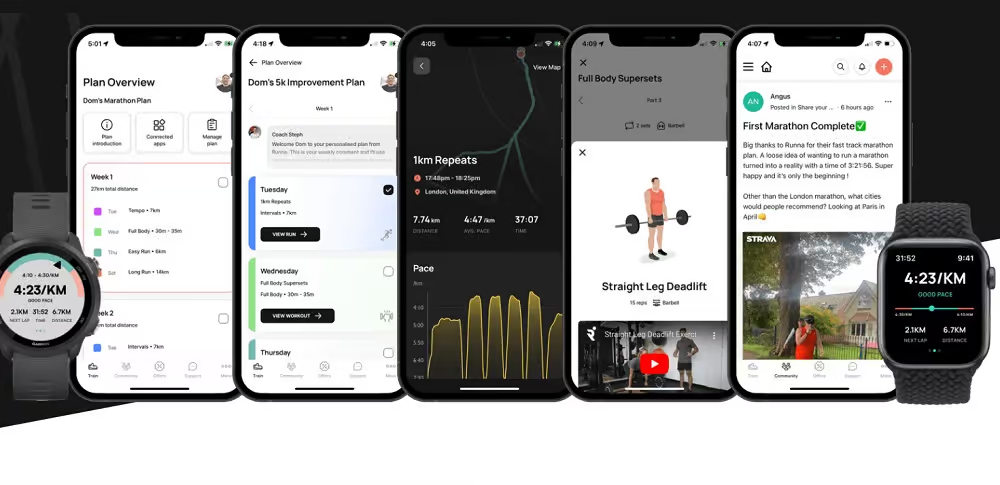

When Runna raised £1.9m in a Seed funding round, they needed to move fast so they could expand into the US in time to be the official training partner for the LA Marathon.

Once we learned what they needed, we got to work. We simplified Runna’s US contract and consolidated policies so they could be managed more easily in future. In just four weeks, we had put a robust programme in place for their US launch.

What does this mean for my UK policies?

Expanding overseas doesn’t necessarily mean that your UK policies or your relationship with your UK broker will have to change. But as with everything with overseas coverage, it’s best to be proactive about this and speak with your broker as early as possible.

For example, your broker might need to check that your current insurer is going to be happy to go on this journey with you. Some won’t. They’ll know the US market is a bit litigious, where lawsuits are more frequent than their jokes about the UK’s rainfall (also very common). You don’t want to have to delay your US expansion because your UK cover also has to change at the last minute.

As we’ve said, the first step to answering these questions is to speak to a broker who specialises in helping scale-ups stay covered as they expand into the US. If you want to have a conversation about what you need, book a 30 minute call with our team.